Introduction

The Payments and Lending market is expected to reach ~USD 9.8 trillion worldwide by 2025. In a recent webcast, 60% of nearly 2,000 participants cited adoption of electronic payments as the most meaningful change in the B2B space. Digitisation of the banking industry and developments in new technology have led to customers demanding a seamless experience and real-time payment services.

Meanwhile, the lending marketplace in recent times has undergone a transformational change, driven and supported by FinTechs. Cross-border lending in APAC continues to rise progressively in spite on the ongoing COVID-19 pandemic. Globally, a mix of traditional and alternative lending channels now compete for advantage. Digital lenders have been using nonconventional models to identify customers and assess their credit risk relying on artificial intelligence and big data analytics. Finally, the Buy Now, Pay Later model has emerged globally amid an explosion of demand for cost-effectiveness and convenient payment.

Event Gallery

Testimonials

“Blockchain will play a very important role, not only in the public sector but the private sector also, it is going to be the next defining technology for the world and India is going to adopt blockchain just like it has adopted the digital technology”

J A Chowdary, Chairman, Blockchain committee at Bureau of Indian Standards, Government of India.

“We are looking at AI as the base for the next data revolution”

Rajesh Mirjankar, Managing Director & CEO, Kiya.AI

“We are working with the ecosystem to create technology-led innovation in the payments sector to remove pain points in this (payment) ecosystem”

Mehul Mistry, Wibmo, Global Head of Strategy, Digital Financial Services & Partnerships

“We are moving to a less-cash economy not cashless; the cash will remain in the system for some time, but we are moving very fast towards a digital payment infrastructure and ecosystem. All the infrastructure is in place and many exciting developments are happening in the Indian digital ecosystem. ”

Saugata Bhattacharya, Executive Vice President, and Chief Economist, Axis Bank

“Banks will always be the big elephants in the room so when banks change and adopt FinTech DNA, they will have a profound impact on the customers and the economy”

Gunit Chadha, Founder, APAC Financial Services Pvt. Ltd., Ex-CEO of Deutsche Bank, Asia-Pacific

Speakers

Akshay Mehrotra

Co Founder & CEO, EarlySalary.com

Bharat Panchal

Chief Industry Relations & Regulatory Officer - India, Discover Financial Services

Gautam Narayan

Partner at Apax

Gunit Chadha

Founder, APAC Financial Services Pvt. Ltd., Ex-CEO of Deutsche Bank, Asia-Pacific

Mehul Mistry

Global Head of Strategy, Digital Financial Services & Partnerships, Wibmo, a PayU Company

Nitin Chugh

Deputy Managing Director and Head of Digital Banking, State Bank of India

Rajesh Mirjankar

Managing Director & CEO, Kiya.ai

Rajiv Janjanam

Senior Vice President II – Digital Retail, MSME, Working Capital & Digital Lending, RBL Bank

Saugata Bhattacharya

Executive Vice President and Chief Economist, Axis Bank

Shekhar Bhandari

Sr. VP & Business Head, Global Transaction Banking, Kotak Mahindra Bank

Suhail Sameer

CEO, BharatPe

Vikas Kumar

CTO & Co-Founder, LoanTap

Sanjiv Anand

Chairman, IBS Intelligence

V. Ramkumar

Senior Partner, Cedar Management Consulting International

Nikhil Gokhale

Head of Research, IBS Intelligence

Robin Amlôt

Managing Editor, IBS Intelligence

Gaia Lamperti

Reporter Global Markets, IBS Intelligence

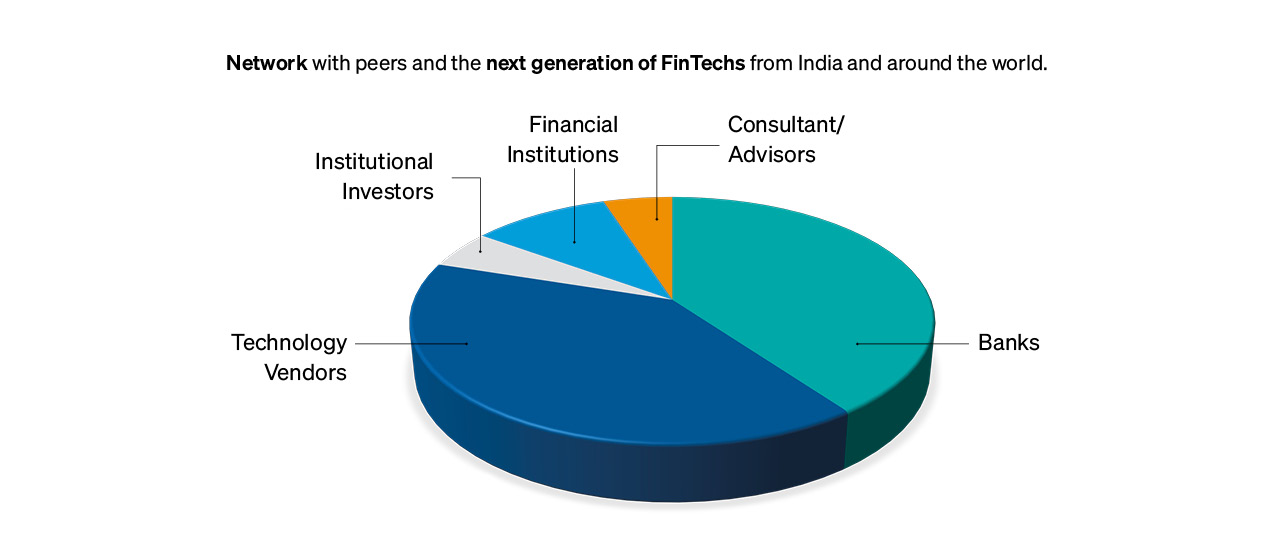

Delegate Profile

- Chief Executive Officer

- Chief Technology Officer

- Chief Risk Officer

- Chief Compliance Officer

- Chief Product Officer

- Head of Payments

- Head of Payments Operations

- Head of Emerging Payments

- Head of Operations

- Head of Product (Payments)

- Head of Retail Payments Policy

- Head of Cash Management

- Head of Transaction Banking

- Head of Real-Time Payments (RTP)

- Head of Fraud / Compliance

- Head of AML

- Head of Digital / Innovation

- Head of Digital / Digital Bankings

Industries Represented

Get in touch

Tim Willmott

Head, Global Media Sales

M.: +44 7703 589 069

E.: timw@ibsintelligence.com

Anshika Mishra

Sr. Manager Events and Alliances

M.: +91 9819 749498

E.: anshikam@ibsintelligence.com