US Dominates North American BankTech Deals with 94% Market Share, IBS Intelligence Data shows

By Puja Sharma

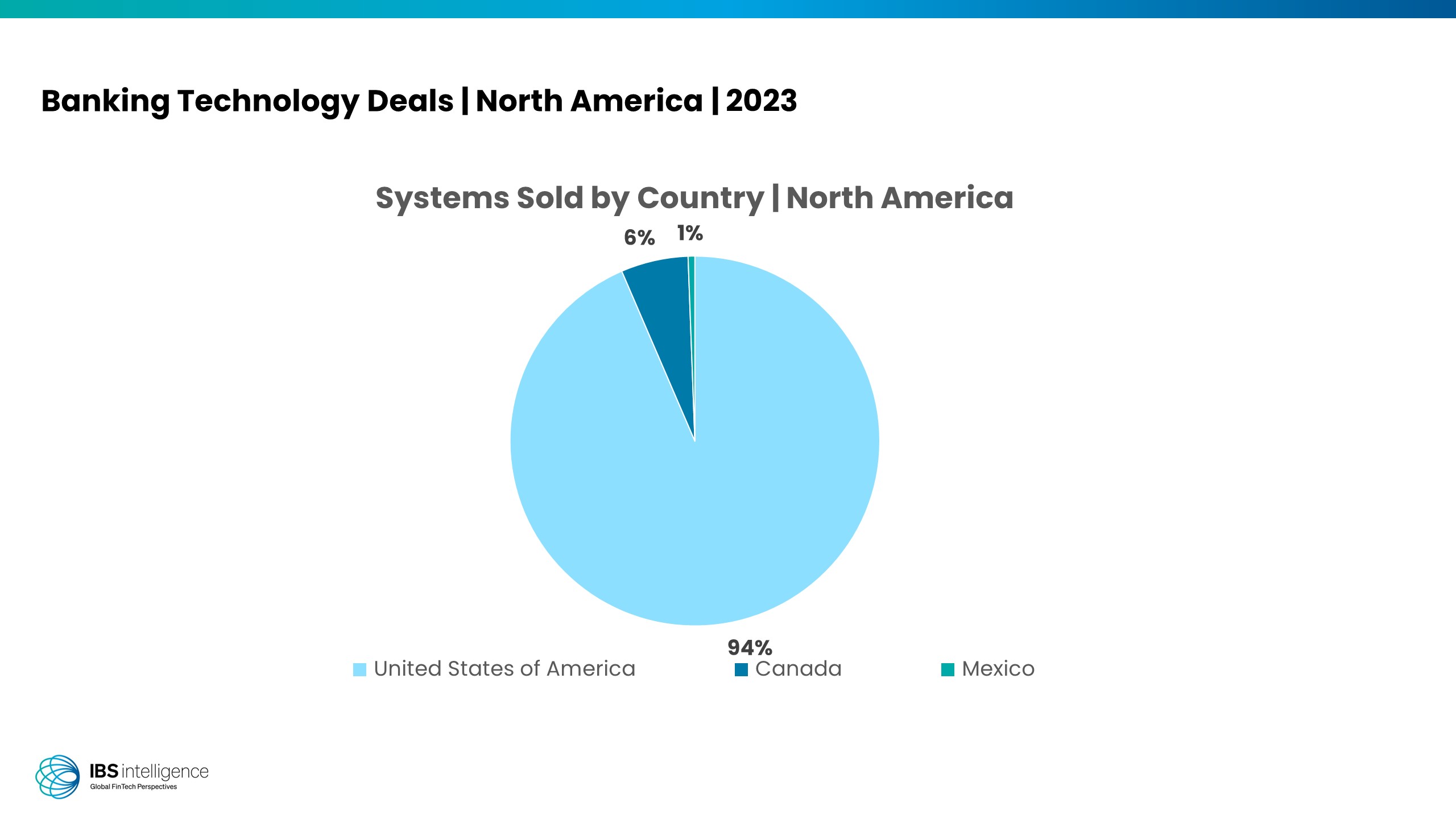

According to data from IBS Intelligence, the US accounted for 94% of BankTech deals in North America in 2023, reflecting significant market dominance. Its large market size naturally attracts more investment and deals in banking technology.

According to data from IBS Intelligence, the US accounted for 94% of BankTech deals in North America in 2023, reflecting significant market dominance. Its large market size naturally attracts more investment and deals in banking technology.

With a large population and a highly developed financial services industry, there is constant demand for innovative banking technology solutions to cater to a range of consumer needs and regulatory requirements. Several factors account for the US dominance in BankTech deals:

Technological Innovation and Adoption: The US is often at the forefront of technological innovation, particularly in the financial services sector. American banks and financial institutions are more inclined to adopt cutting-edge technologies such as artificial intelligence, blockchain, and cloud computing to enhance efficiency, security, and customer experience. This proactive approach to technological adoption, as evidenced by the many BankTech deals, creates fertile ground for partnerships and collaborations in the industry.

Regulatory Environment: While stringent, the regulatory environment in the US also fosters innovation in the banking sector. Regulatory bodies such as the Federal Reserve and the Office of the Comptroller of the Currency (OCC) encourage competition and innovation by fostering a conducive environment for FinTech startups and partnerships between traditional banks and technology companies. This regulatory clarity and support contribute to the proliferation of BankTech deals in the US.

Investor Confidence and Funding: The US has a robust ecosystem of venture capital firms, private equity investors, and institutional investors actively investing in FinTech and BankTech startups. The availability of funding and a supportive investor community enable startups to scale and expand their operations, driving more deals and partnerships in the BankTech space.

Cultural and Economic Factors: The entrepreneurial culture and risk-taking mindset prevalent in the US also play a significant role in driving BankTech deals. American entrepreneurs and innovators are more willing to take risks and disrupt traditional banking models, leading to a vibrant ecosystem of FinTech startups and collaborations with established financial institutions.

Contrasting with US dominance, IBSi’s data shows that Canada and Mexico accounted for 6% and 1% of BankTech deals in 2023, respectively. While they also experience some level of technological innovation and regulatory developments in the banking sector, they may not attract as many BankTech deals due to their relatively smaller market size, lower levels of technological adoption, and different regulatory landscapes. Additionally, cultural factors and access to funding may influence the number of BankTech deals in these countries.

IBSi Daily News Analysis

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Related Reports

Sales League Table Report 2024

Know More

Global Digital Banking Vendor & Landscape Report Q2 2024

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

IBSi Spectrum Report: Supply Chain Finance Platforms Q4 2023

Know More