Islamic Banking Trends: Where Tradition Meets Technology

By Raji Challita, CEO, BML Istisharat

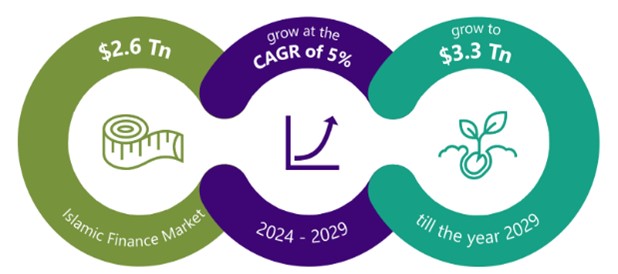

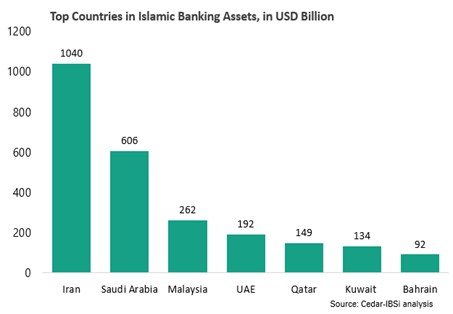

The global Islamic finance industry is expected to grow by 10-15% next year, with the Middle East acquiring almost 77% of total Sharia-compliant assets. Both Iran and Saudi Arabia hold the largest share of Islamic banking assets.

Even though Islamic banking was traditionally concentrated in the Middle East and Southeast Asia, it has been experiencing significant expansion worldwide. The ethical foundation upon which Islamic products were founded like no interest, profit sharing and asset-backed finance, has resonated with both investors and banking customers seeking products that align with those values.

This collaborative approach to saving and risk sharing, for instance, was one of the main principles that attracted customers. it has unleashed a demand for products like Jamiyaa, a rotating saving pot that allows a community to save and borrow with no interest. Also, Takaful Insurance pools funds from policyholders to cover losses faced by one of its participants.

Ethical investment is another trend that has grown along with Islamic banking, driven by consideration of both the societal and environmental impacts. Accordingly, increasing awareness of ecological, social, and governance (ESG) factors. Therefore, Green Sukuk, Shariah-compliant bonds, are used to fund environmentally friendly projects following Islamic principles and promoting sustainability.

The evolving landscape of FinTech has converged this untapped demand, leveraging those new trends:

Open banking: Islamic banks are currently moving towards having continuous integration with Fintech APIs to directly serve customers with Sukuk Investment Platform Integration, or Jamiyaa, and insurance Takaful products. Such ease in integration and increasing product offerings has enabled the banks to not only increase customer satisfaction, but also provide a personalized experience that would later grow and retain this customer. For instance, Islamic banks are currently personalizing Hajj Savings Goals and Zakat Planners and Calculators, therefore becoming more inclusive and personalized.

RegTech solutions have eased the growth of Islamic banks lately, especially in Sharia compliance monitoring, which involves a detailed analysis of banking products. Therefore, it ensures that the contracts, transactions, and other financial activities within the bank follow the Sharia principles. Since complex regulation authorities and sharia complying were hindering growth, RegTech tools have resolved it quickly. Regtech helps in risk management by suggesting risk mitigation strategies, conducting risk assessments for the bank, and providing scenario-based modelling.

Growing Focus on UI/UX and Digital Customer Experience as competition has heightened, Islamic banks have invested in providing a smooth and attractive digital experience, rivalling both Islamic and conventional banks.

The adoption of artificial intelligence has also increased Islamic banking efficiency and maximized customer value. Islamic banks are streamlining middle office functions such as compliance and anti-money laundering. Thus, Islamic banks can monitor the use and source of funds to meet sharia requirements. Additionally, Islamic banks have employed robo-advisory with Sharia expertise to clarify and assist in guiding clients’ investment decisions.

The adoption of artificial intelligence has also increased Islamic banking efficiency and maximized customer value. Islamic banks are streamlining middle office functions such as compliance and anti-money laundering. Thus, Islamic banks can monitor the use and source of funds to meet sharia requirements. Additionally, Islamic banks have employed robo-advisory with Sharia expertise to clarify and assist in guiding clients’ investment decisions.

For a long time, Islamic banks have struggled to provide the ease and flexibility of their conventional counterparts. Islamic Banking customers have access to equivalent saving and investment products that are not only limited but complex in nature and regulatory requirements. Thus, the enablement of FinTech integration has bridged the gap between customers and Islamic banks. Now that Islamic banks can increase their reach and reduce complexity, they are able to expand and rival conventional banks.

IBSi News

July 19, 2024

BML Istisharat

Ecommpay & Mastercard partner to deliver Click to Pay in Europe

Read More- Daily insightful Financial Technology news analysis

- Weekly snapshots of industry deals, events & insights

- Weekly global FinTech case study

- Chart of the Week curated by IBSi’s Research Team

- Monthly issues of the iconic IBSi FinTech Journal

- Exclusive invitation to a flagship IBSi on-ground event of your choice

IBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related Blogs

July 10, 2024

When cyber criminals log in, but don’t break in, is your data still data secure?

Read MoreJuly 05, 2024

From self-governance to sustainable growth: how the SRO-FT empowers India’s FinTech revolution

Read MoreRelated Reports

Sales League Table Report 2024

Know More

Global Digital Banking Vendor & Landscape Report Q2 2024

Know More

NextGen WealthTech: The Trends To Shape The Future Q4 2023

Know More

IBSi Spectrum Report: Supply Chain Finance Platforms Q4 2023

Know More